Our Services

At N'Spired Concierge Consulting & Development we provide you with the tools, resources and expertise that will help you to establish a successful business. Our goal is to exceed your expectations by providing you with services that will take your business to the next level.

LLC Business Formation

A Limited Liability Company, or an LLC, is a relatively new business structure that first appeared in Wyoming in 1977, and is now recognized by every State’s statute and the IRS. An LLC is neither a partnership nor a corporation, but a distinct type of business structure that offers an alternative to those two traditional entities by combining the corporate advantages of limited liability with the advantages of pass-through taxation usually associated with partnerships.

Limited Liability Companies are becoming more and more popular, and it is easy to see why. In addition to combining the best features of partnerships and corporations, LLCs avoid the main disadvantages of both of those business structures. Limited liability companies are much more flexible and require less ongoing paperwork than corporations to maintain them, while avoiding the dangers of personal liability that come with the partnership. Some examples of famous LLCs may surprise you – both Amazon and Chrysler are organized as limited liability companies.

Essential Formation Package Includes

- Preparing and Filing the Articles of Organization

- Name Availability Search

- 24-Hour Document Preparation

- Obtain Federal Tax ID Number (EIN)

- Operating Agreement

- Print Delivery

- W-9

Name Availability Search

N'Spired Concierge will check your desired name against the state registration database to determine name availability. This process reduces the likelihood of your documents being rejected by a state official.

24-Hour Document Preparation

No Delays! Once your order is placed we confirm the availability of your company name with the state office. If the name is available we prepare and submit your formation documents for filing within 24 hours.

FREE Corporate Compliance Tool: BIZ

N'Spired Concierge B.I.Z. (Business Information Zone) is a FREE corporate compliance concierge tool that allows you to receive reminders for important due dates like tax deadlines & annual report filings, view and print official business documents all stored securely in the cloud.

Obtain Federal Tax ID Number (EIN)

Businesses are required to obtain a Federal Tax ID, also called an Employer Identification Number (EIN) which is used to identify the business entity. With Essential Bookkeeping Services Tax ID service, we will obtain your company's Tax ID from the IRS once your business formation is approved by the state office.

Print Delivery

Your order includes free paperless delivery. You'll be able to download PDF versions of your documents. If you prefer to receive hard copies printed on quality paper, then add this option and your business documents will be mailed to you based on the processing speed that you choose. At an additional Shipping & Handling fee.

Deluxe Formation Package Includes

All of the items in the Essential Formation Package, plus the additional items listed below

- Professional Email

- Professional Voicemail

- Business Domain

Professional Email

It’s a must to have a professional email. It shows that you have a high quality of standards when it comes to your business. It sets you apart from all of the other business owners that doesn’t have a professional email. Your email address with @ your domain name instead @gmail.

Professional Voicemail

When you receive a business call and your not available to answers the caller will be welcomed with a professional greeting detailing information about your business, your tagline and additional contact information.

Operating Agreement

An LLC Operating Agreement is a legal document that outlines the ownership and member duties of your Limited Liability Company. This agreement allows you to set out the financial and working relations among business owners (“members”) and between members and managers.

It’s also a document which describes the operations of the LLC.

Business Domain

A domain name is the address where potential clients can access your website. It can make the difference between creating a successful Web presence and getting lost in cyberspace. A domain name adds credibility to your small business. Any individual, business or organization planning to have an Internet presence should invest in a domain name. A domain name will also protect copyrights and trademarks, build credibility, increase brand awareness, and search engine positioning.

Dun & Bradstreet Number

The Data Universal Numbering System, abbreviated as DUNS, is a proprietary system developed and managed by Dun & Bradstreet. A DUNS number is a unique nine-digit identifier for a business created by credit bureau Dun & Bradstreet. Dun & Bradstreet is one of the three major business credit bureaus. DUNS numbers have become the standard numbering system to identify businesses across the globe.

ALL THINGS TRUCKING

* Motor Carrier Authority

* Driver Qualification File

* Drug & Alcohol Consortium

* ClearingHouse Account Set-Up

* Compliance Specialist

* IRP Application/Renewals

* 2290 HWUT

* IFTA Account Set-Up

* IFTA Quarterlies Filing

* BOC-3

* UCR

See More Details In Our Safety & Compliance Page

Business Credit Built For You

The Building Business Credit Wealth Program

“We’ll Build Your Business Credit While YOU Focus On Your Brand, Business Growth Profitable Margins”

Interactive strategies with methodology techniques has proven winning results for our clients

Services Included

Correct NAICS & Sic Code

Fundable Profile To Lender

Support via Phone, Text Email

Dun & Bradstreet Profile Setup

Establish Your Business Credibility

Business Credit Bureaus Profile Setup

Recommended Tradelines For Tier 4 & Tier 5

Monitor and Analyze Your Business Credit Reports

Strategies and Tips For Business Credit Foundation

Proper Reporting Tradelines For Tier 1, Tier 2 & Tier 3

Educational Guidance On Building Business Credit Wealth

Business Credit Scores Dun & Bradstreet, Experian & Equifax

Structure Your Business Credit Portfolio For Business Funding

Professional Business Credit Structure Profile For Vendors, Lenders & Banks

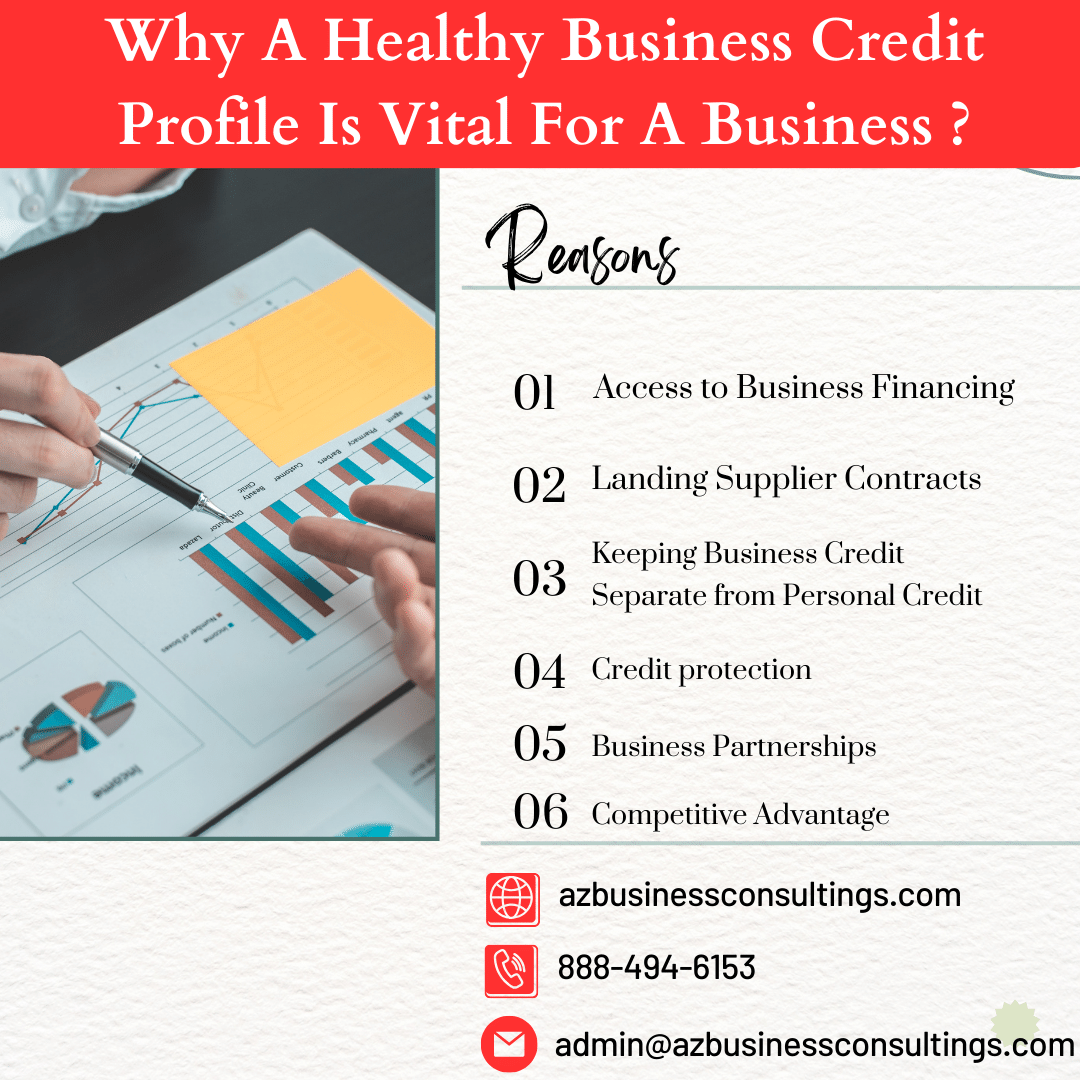

Business Credit

Building a business credit score should be top of mind when starting your business

You’ll be hard-pressed to find a successful business that has never used OPM — Other People’s Money — to level up. And they got OPM with good business credit.

Business credit is used by lenders to determine if your company can be trusted to repay debts. The better your business credit score, the more opportunities to access funds for expansion. The lower your business credit score the harder you will have securing funding for the growth of your business.

When you’re starting a business, building credit can be challenging. Many small business owners have no established business credit history and cannot secure a small business loan from banks or other financial institutions. Fortunately, there are many ways to improve your credit score that will only improve your financial standing, including paying off debt and establishing lines of credit. Think of your business credit score as a Google review for a company’s financial trustworthiness. Most people wouldn’t spend their money in an establishment that consistently gets one-star ratings and scathing comments from dissatisfied customers, right? Similarly, a business credit score helps lenders decide if they want to lend money your business. Business credit works kind of like personal credit, the more you pay on time, the better your business profile will look. Even if a business has healthy savings, using OPM is preferred by many owners. The National Small Business Association says that roughly one-in-four businesses it surveyed claimed they were unable to receive the funding they needed. And that lack of funding frequently prevented them from growing their businesses.

In a capitalistic society, if a business can’t grow, it’s unlikely to succeed. A larger or more nimble competitor will take it out. Having a decent business credit profile is the first step in potentially receiving funding from major lenders and building a thriving company.

G00d Business Credit Score

A business credit score indicates your company’s ability to repay another entity, such as a bank or vendor, who extends you money for services rendered by your company. A high-scoring business credit gives you more options for paying payroll, purchasing inventory, create a financial safety net,

how-to-find-small-business-funding, leasing office space, hiring employees, and acquiring other assets that help you grow your company. Even if a business has healthy savings, using OPM is preferred by many owners. The higher a business’s credit score, the more likely that business is going to be able to receive funding. Business Credit extended to a business can be used to pay payroll, purchase inventory, create a financial safety net, and cover many other essential company needs.

A Business credit score is crucial for obtaining funding for launching and expanding businesses and can also help save money. For example, a good business credit score can help business owners qualify for better interest rates and enable small businesses to obtain credit without the need for a personal guarantee, which reduces personal liability.

Different ranges are used for business and personal credit scores. While a personal credit score can be between 300 and 850, business credit scores are between 0 and 100, with 100 representing the highest score or lowest risk of missing payments.

For personal credit, a score of 670 or above is considered good, while for business credit, a score of 80 or above is considered good.

A good business credit score signals to lenders that you aren’t a fly-by-night operation, and that they can reliably lend to you. It takes time and diligent payment habits to build your score up, but the rewards will be well worth it. general, business owners should strive for a higher credit score to ensure that they have access to the options and resources they need to help their businesses thrive. Also, please keep in your business will need a solid credit score to earn the respect of potential creditors.

How To Build Business Credit Without Using Personal Credit

Business owners should open a business credit tradelines, card and loans using their EIN number only and not their social security number. That way the payment activity will be filed on the business credit report and build the business credit profile. The tradelines should report to Dun & Bradstreet to ensure a Paydex score of 80. The business credit tradelines should also report to Equifax and Experian to receive a positive score for funding By keeping personal and business credit separate, small business owners can make sure that any financial challenges that occur on one credit profile do not affect the other Separating business credit from personal credit is critical for business owners because if the business becomes at risk, the owner’s personal credit will also be affected.

Business Funding

Business funding is undeniably important for many businesses, but its significance can vary depending on factors such as the nature of the business, its stage of development, and its growth ambitions. Business funding refers to the process of securing financial resources to start, grow, or sustain a business’s operations. Securing the right type of funding is crucial for businesses to meet their financial needs, invest in growth opportunities, and manage day-to-day expenses.

Choosing the right source of funding depends on your business’s specific needs, stage, and financial situation. It’s essential to carefully consider the terms, costs, and implications of each funding option and create a solid business plan to demonstrate your ability to repay loans or attract investors. Consulting with A’Z Business Consulting and Developments can also provide valuable guidance in securing the right funding for your business.

Here Are Some Common Sources Of Business Funding:

Bootstrapping: Bootstrapping means self-funding the business using its generated revenue. It involves reinvesting profits back into the business rather than seeking external funding.

Bank Loans: Traditional bank loans, including term loans and lines of credit, are a common source of funding for businesses. However, they often require a good credit history and collateral.

Business Incubators and Accelerators: These programs provide not only funding but also mentorship, resources, and networking opportunities to startups in exchange for equity.

Competitive Advantage: Businesses with access to sufficient funding may gain a competitive advantage by seizing market opportunities more quickly than their underfunded competitors. This can lead to market share growth and increased profitability.

Diversification: Funding can enable businesses to diversify their product or service offerings, reducing reliance on a single revenue stream and enhancing resilience.

Growth and Expansion: As businesses grow, they often require additional capital to scale their operations, expand into new markets, and invest in infrastructure. Funding can fuel growth by enabling companies to hire more employees, increase production capacity, and reach a broader customer base.

Marketing and Branding: Effective marketing and branding efforts are essential for reaching and engaging customers. Funding can support marketing campaigns, advertising, and brand-building initiatives.

Online Lenders: Online lenders offer a range of financing options, including term loans, lines of credit, and invoice financing. They often have more lenient qualification criteria and faster application processes than traditional banks.

Revenue-Based Financing: Some companies offer funding in exchange for a percentage of future revenue. This can be a flexible option for businesses with fluctuating income.

Startup Capital: For new businesses, especially startups, funding is often critical to get off the ground. It helps cover initial expenses such as product development, marketing, hiring, and acquiring necessary assets. Without sufficient startup capital, many businesses would struggle to launch and establish themselves in the market.

Survival and Sustainability: Even established businesses can face financial challenges. Adequate funding can be vital for weathering economic downturns, managing cash flow, and ensuring the sustainability of operations during tough times.

Talent Acquisition: Attracting and retaining top talent often requires competitive compensation packages. Funding allows businesses to offer competitive salaries and benefits, helping them secure the best talent in their industry.

Business funding offers numerous advantages, it’s important to note that while majority businesses require external business funding, many small business thrive with it.

Ultimately, the importance of business funding depends on the specific goals, needs, and circumstances of the business owner or entrepreneur. A well-thought-out business structure plan should guide funding decisions, ensuring that the chosen financing method aligns with the business’s objectives and growth strategy.

Let’s Talk About Your

Business Goals!

All of our services are affordable even as we offer the highest quality of services anywhere!